THE DATA

Reviewing Premium Rates and producing information required by HHS is best accomplished if Insurance Companies supply information in an established Industry-neutral data standard (e.g. csv or xml) in addition to the PDF format required by SERFF. This makes for easy and automated reading.

In addition, the data must be clearly and unambiguously identified using an agreed-upon labeling system. The labeling system used needs to support multiple labeling schemes, e.g. Claims Category labels, Risk labels etc., needed for multiple kinds of analyses.

RATE FILINGS

Validation of A&H Assumptions and projections

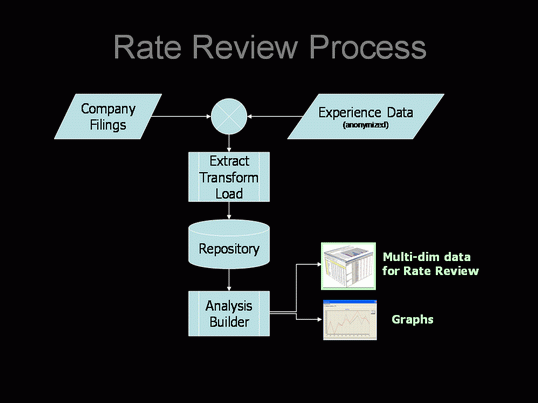

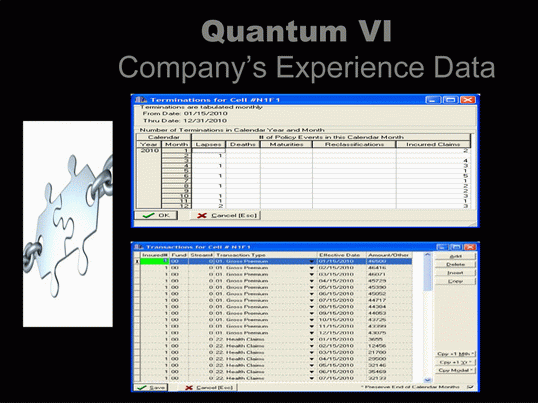

This can be a complex area. The solution that we have developed employs very sophisticated software combined with company plan definitions and provisions and policyholder experience data. To enable granular analysis, this data is organized, integrated and tagged using hierarchical/multi-dimensional labels. This allows for significantly superior verification of the assumptions and projections. In addition, this data can be archived with other filings in a Data Mart that is mined to provide important statistics on costs and trends, and to provide required reporting to the HHS.

Based on this organized and labeled data, trends, sensitivities or other variables used in the calculations can be verified. This data can be used stand-alone, or in combination with data from other filers. Using information from multiple companies provides for better algorithms used in projecting premiums, expenses, mortality, lapse rates and claims.

Processing A&H Rate Filings

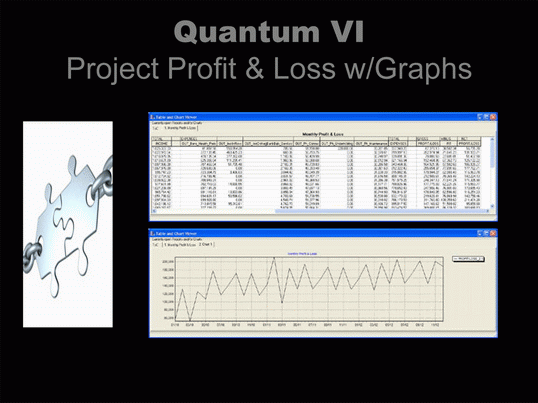

When assumptions have been validated, the software is then used to project the cash flows and reserves for the in-force (or a model based on the in-force). The system will then report key statistics such as the ratio of present value of claims to present value of premiums, and the projected reserves and profits. These are just some of the results that can be used to determine the reasonableness of any premium rate filing.

The QVI Process

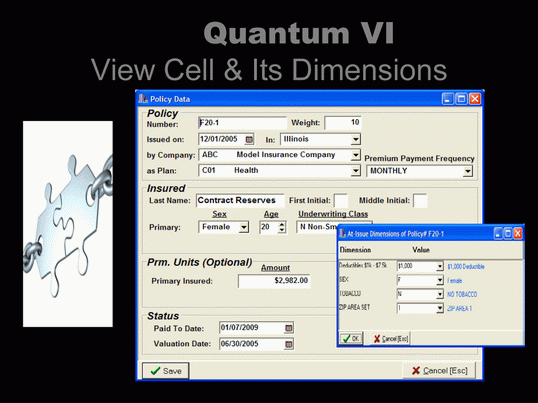

Our software (Quantum VI) is a single, totally-integrated system. The software can also be used to verify reserves for all plans of Health, Life and Annuity Insurance that are currently sold in the United States.

IN PICTURES

Reviewing Premium Rates and producing information required by HHS is best accomplished if Insurance Companies supply information in an established Industry-neutral data standard (e.g. csv or xml) in addition to the PDF format required by SERFF. This makes for easy and automated reading.

In addition, the data must be clearly and unambiguously identified using an agreed-upon labeling system. The labeling system used needs to support multiple labeling schemes, e.g. Claims Category labels, Risk labels etc., needed for multiple kinds of analyses.

RATE FILINGS

Validation of A&H Assumptions and projections

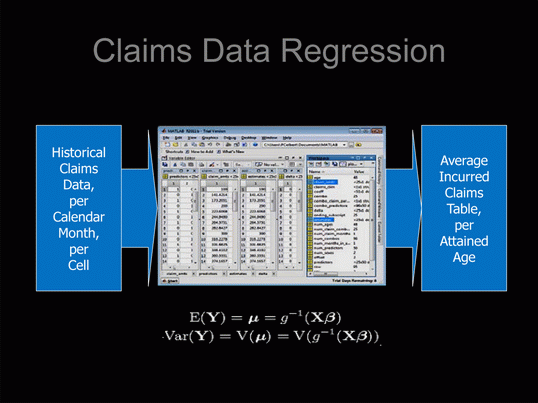

This can be a complex area. The solution that we have developed employs very sophisticated software combined with company plan definitions and provisions and policyholder experience data. To enable granular analysis, this data is organized, integrated and tagged using hierarchical/multi-dimensional labels. This allows for significantly superior verification of the assumptions and projections. In addition, this data can be archived with other filings in a Data Mart that is mined to provide important statistics on costs and trends, and to provide required reporting to the HHS.

Based on this organized and labeled data, trends, sensitivities or other variables used in the calculations can be verified. This data can be used stand-alone, or in combination with data from other filers. Using information from multiple companies provides for better algorithms used in projecting premiums, expenses, mortality, lapse rates and claims.

Processing A&H Rate Filings

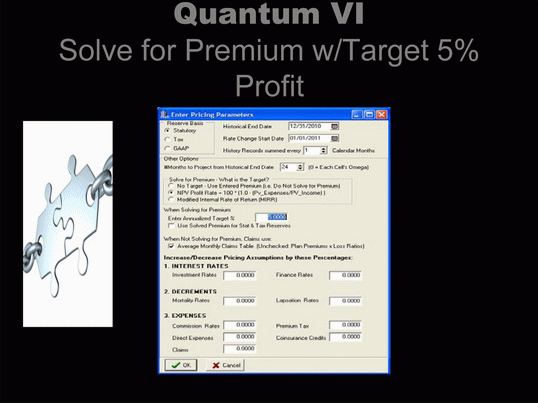

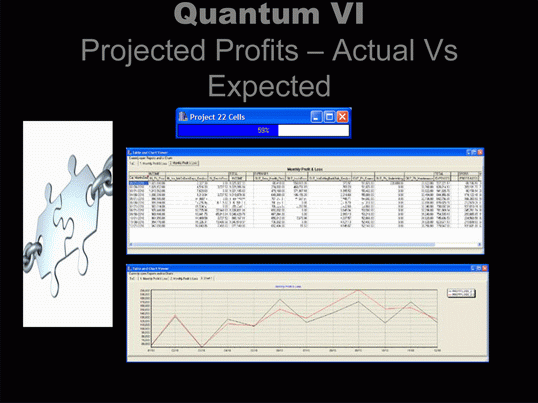

When assumptions have been validated, the software is then used to project the cash flows and reserves for the in-force (or a model based on the in-force). The system will then report key statistics such as the ratio of present value of claims to present value of premiums, and the projected reserves and profits. These are just some of the results that can be used to determine the reasonableness of any premium rate filing.

The QVI Process

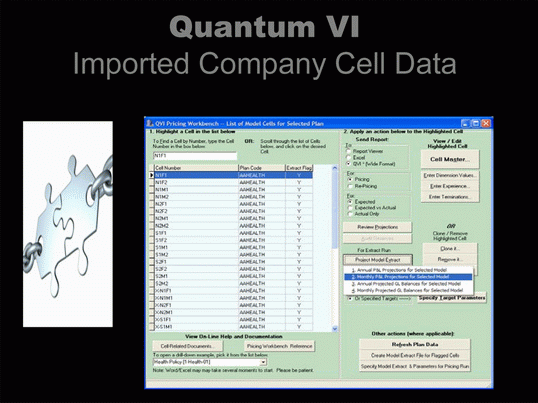

Our software (Quantum VI) is a single, totally-integrated system. The software can also be used to verify reserves for all plans of Health, Life and Annuity Insurance that are currently sold in the United States.

- The system projects Cash Flows for each block of Health business.

- It does so by projecting claims, expenses, premiums and investment income etc. as if the block was a single “notional’’ company whose only business is the particular block being audited.

- It accomplishes this by populating a notional General Ledger from projected financial journals; which in turn project the Assets, Liabilities (including Statutory and Tax Reserves) and profit streams for that block of business.

- The system provides detailed first-principles audits for every projected journal, and can be easily checked by anyone with a basic accounting background.

- The resulting profit streams are then reviewed for reasonableness. If the profits are considered unreasonable, then the system will solve for rate levels that the department can accept. The Filing Company would then have the opportunity to submit objections to the projections produced from the system.

- The projection of the Notional General Ledger is the final step in the Audit Process. The projections employ tables and assumptions that are produced by the system from experience data submitted by the Insurance Company in its filings.

- This data is not the same information provided in a SERFF filing which mainly deals with documents in PDF format. Instead, the data used is in a standardized CRC .csv format, and can be supplied in this format by an Insurance company, or mapped into this format by a converter used by the Department.

IN PICTURES

AUDIT RESERVES

To conduct a proper Rate Review, it is very important that the Company is holding and projecting correct reserves. Therefore, Job #1 is to audit a company’s reserves before running the Rate Review Analysis that projects these reserves in its notional cash flows.

To accomplish this goal, QVI-Auditor™ provides a unique and powerful tool that calculates and audits Stat/Tax/GAAP and Gross Premium Reserves. In addition, it supplies a complete set of First-Principles Audits to verify its calculations. Using this tool, States can spot-check and verify Reserve filings (Micro), and run complete seriatim valuations for a block of business (Macro).

The software has been used by State Insurance Departments, the IRS and large Accounting firms to audit filings.

To conduct a proper Rate Review, it is very important that the Company is holding and projecting correct reserves. Therefore, Job #1 is to audit a company’s reserves before running the Rate Review Analysis that projects these reserves in its notional cash flows.

To accomplish this goal, QVI-Auditor™ provides a unique and powerful tool that calculates and audits Stat/Tax/GAAP and Gross Premium Reserves. In addition, it supplies a complete set of First-Principles Audits to verify its calculations. Using this tool, States can spot-check and verify Reserve filings (Micro), and run complete seriatim valuations for a block of business (Macro).

The software has been used by State Insurance Departments, the IRS and large Accounting firms to audit filings.